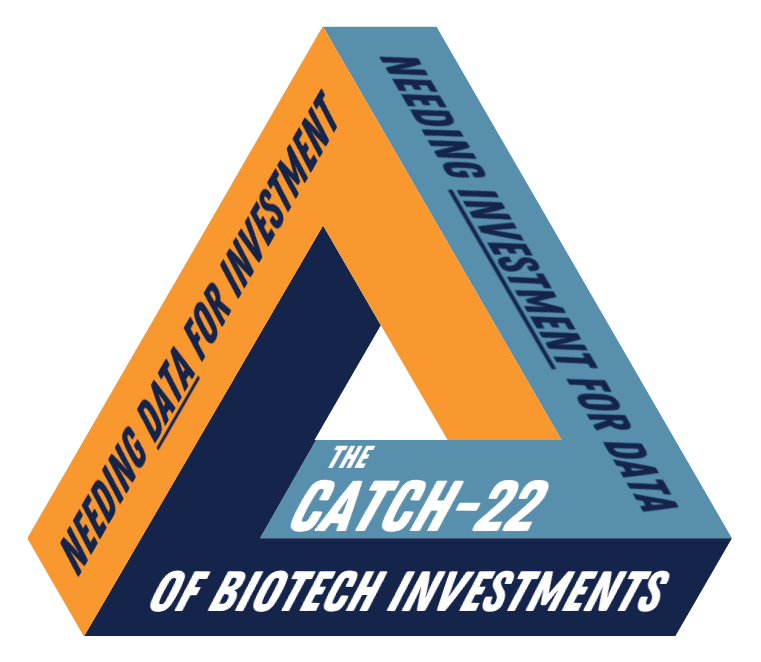

Securing biotech investments can be challenging for a biotech start-up. Biotech investors and healthcare private equity firms want to see strong, promising data before investing. In biotech, a large investment from life science investors is often needed to generate data on drug delivery, efficacy, and safety in humans. Securing this essential, often initial, investment can be seen as the catch-22 for biotech start-ups and scale-ups. Simply put, the solution to the problem becomes the problem itself. Our CBO at TRACER, Ari Aminetzah, elaborates in this blog on how to deal with this catch-22.

Fundraising for biotech start-ups

“If you’ve been part of a biotech startup, like me, you’ve likely felt that fundraising can be a strenuous task. In my role as CBO at TRACER, I discuss with start-ups and scale-ups how to escape this situation. I advise them from my own experience and our case studies. Feel free to request a meeting with me.”

The catch-22 of getting biotech investment (and how to escape)

The biotech investments catch-22: Generate data to secure funding while you need funding to generate data.

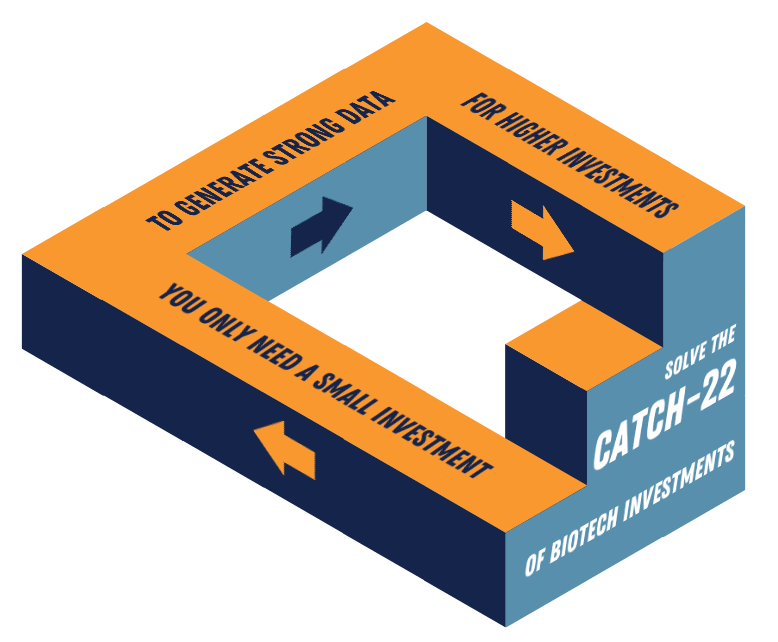

How to escape this paradox?

- Use smarter clinical trial strategies to obtain strong data early on.

- Add Phase 0 de-risking mechanism to your milestones.

- Find biotechnology venture capital firms that are willing to invest in your company stage.

- Look for firms that are actively looking for biotechnology companies to invest in.

- Submit your application to specific biotech venture funds in your region and area of interest.

- Keep track of trends in healthcare and life science investments.

- Focus on value creation, since that is what investors are looking for.

- Spend your money wisely and focus only on achieving the milestones that investors are using as an entry or exit strategy.

Deliver Proof of Concept (PoC) to life science investors

The Proof of Concept Phase 0 imaging study checks all boxes when it comes to escaping the catch-22. Looking at it from the point of view of life sciences and medical investors, conducting Phase 0 is a smart clinical trial strategy that can provide the proof needed to justify further investments for Phase 1. Phase 0 is a translational clinical trial that moves biotech start-ups directly from the preclinical into the – for investors more attractive – clinical stage. When proof of concept is obtained, there is immediate value creation. The investment required for Phase 0 is usually lower than for Phase 1. Sometimes, this means that a start-up, even without knowing it, already has enough resources to bring their development into the clinic.

Request a quote for your Phase 0 study.

In short, what are PoC Phase 0 imaging studies?

Are you not completely sure what PoC, Phase 0, or imaging studies are? In short:

- Phase 0 was introduced in 2006 by the FDA to speed up drug development and to reduce the high number of failures in clinical trials.

- Imaging studies refer to the use of imaging methods in clinical trials like PET/SPECT or fluorescent imaging to visualize Pharmacokinetics (PK) and Biodistribution (BD).

- PoC studies (sometimes referred to as Proof of Principle or Proof of Value) have one clear objective: to obtain PK/BD data that supports the feasibility of the drug for the targeted indication(s). This data can be used to increase the chances of success in the next phases of clinical trials.

Phase 0 is a de-risking mechanism

Biotech investors are conscious that by far most clinical trials fail. Only about 10% of novel therapeutics in development will make it to the market. Therefore, other exit strategies such as out-licensing or Mergers and Acquisitions (M&A) are common for life science investments. Including the Phase 0 approach in your story to life science investors, and healthcare private equity firms, will show them that you have taken measures to reduce their investment risk. You merely need the limited funding to conduct a Phase 0 imaging trial first. In other words, the needed capital to move into the clinic is significantly lower than with a Phase I study.

Phase 0 clinical trial as first milestone in biotech investment

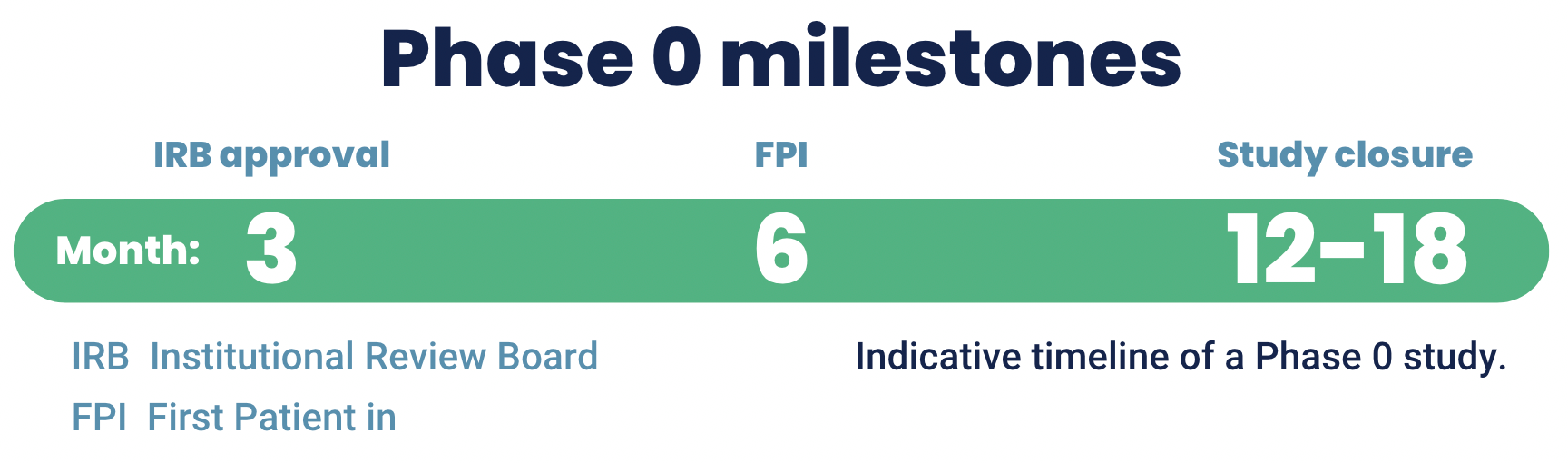

Proof of Concept data in patients can be obtained as early as 12-18 months. With positive (on-target) data, the likelihood of success of the compound is increased, making it easier to raise funding for subsequent clinical trials. By including Phase 0 as first in-human trial in your business plan, the investor receives a clear milestone. This could also be a milestone in a term sheet with investors. So, if you obtain positive data, it could mean the next amount of funding becomes available.

Phase 0 is a clinical trial with clear milestones and a fast timeline

A Phase 0 imaging trial can deliver data fast and has clear milestones.

- IRB approval is fast, within a maximum of 12 weeks (without requests for information (RFIs).

- First patient in can be as fast as 6 months from the start of the project at TRACER.

- Study closure can be as fast as 12-18 months after the start of the project.

Move your start-up into the more attractive stage for investors

On the websites of biotech investors, and life science investors you might see clinical trial phases as a criterion for investing. These are often Phase I-IV and preclinical. Phase 0 comes before Phase I and can replace part of the preclinical work. This means that also for biotech start-ups struggling to raise funding for late-stage preclinical trials, Phase 0 can break their catch-22.

Reach out to learn how Phase 0 can replace parts of the preclinical work.

Information for investors in health, medical, life science, and biotech

As an investor, you don’t need a comprehensive understanding of Biodistribution (BD) and Pharmacokinetics (PK). The data is provided by TRACER clearly and understandably.

- Phase 0 is a clinical trial in patients that express the target of interest.

- In a basket trial the compound can be tested on multiple indications, providing data on efficacy per indication.

- PK/BD data from imaging shows visually the distribution of the compound in-vivo and where it accumulates.

TRACER is specialized in Phase 0 imaging trials. We provide guidance to drug developers and investors considering Phase 0 or adding imaging to other phases of clinical trials. Contact us to learn how this can benefit your drug development investment.

Biotech investments can be secured on more than strong data from preclinical

For biotech investors, data is always a factor used to examine the risk of investment. A lack of data should always be compensated by other factors. For instance, experienced management, a strong market and scientific analysis, impressive partnerships, technology, and intellectual property. A business plan with understandable milestones, a well-defined exit strategy, and risk mitigation plan can also help to secure biotech investments. Especially to get the first biotech investment, start-ups and scale-ups should work on all aspects of their story. Phase 0 can be included as a milestone in the business plan to mitigate risk and offer a clear exit for investors.

A lower investment in your start-up needed

Phase 0 costs are lower than traditional FIH studies, because:

- No need for costly GMP material. Nuclear or fluorescent labeling for imaging during the clinical trial is done at a GMP facility, making the labeled compound GMP grade and fit for clinical use.

- Only a single extended, single-species toxicity study is needed, this is approximately 30% of the costs compared to a full-tox study.

- The Phase 0 clinical trial is conducted in only 5-10 patients, resulting in a lower budget for patient recruitment and for conducting the trial.

For an investor, a lower initial investment, and therefore, less money at risk is significantly more attractive.

Risk mitigation on your biotech investment

Phase 0 mitigates the risk, minimizes time, and maximizes the chances of investment return in several ways, namely:

- Only a limited investment is needed to provide Proof of Concept.

- The acquired Proof of Concept increases company valuation, meaning a fast return on investment can be made and it justifies further investment.

- Data from Phase 0 can be used in Phase I, II and III since the location in the body where the drug accumulates is already identified. Check all benefits of the Phase 0 clinical trial.

- Imaging data from a Phase 0 study, or Phase Ib (imaging trial directly after Phase I) or Phase IIa (imaging trial right before Phase II), can be used to choose indications for the Phase II trial.

Add Phase 0 to your fundraiser pitch

Are you having a hard time convincing biotech investors? Your story might be missing something. Presenting your venture’s story to biotech investors is probably one of the most challenging things founders must undergo to get the required funding generated. Their story should not only present a compelling inspirational message. Life science investors expect solid pre-clinical data and a promising market perspective. It should also share how the new funding will be invested to progress the venture and its program. As a start-up, you have to anticipate the investor’s perspective, the risk taken should be mitigated as much as possible.

Work on your biotech investment strategy

The rest of this article provides information for your biotech investment plan. You’ll learn about investors and investment types to improve your chances of getting funding. The key takeaways are:

- Learn and understand the types of biotech investors.

- Learn how to match your company, resulting in a list of biotech investors to reach out to.

- Find investment programs you simply have to apply for.

In short, how to secure a biotech investment?

How to secure a biotech investment? You need to find a match with an investor. This means, understanding how investors think. Let’s start by identifying the types of healthcare investors.

The category tree for healthcare investors looks something like this. Keep in mind that this list is not complete. It points out the structure and mentions the commonly defined areas or interests from an investor’s point of view.

- Healthcare investors

- Care providers

- Life science investors

- Service providers: e.g. CRO, CDMO and CMO

- Pharmaceuticals

- Biotech investors

- Biopharma investors

- Diagnostics

- Medical devices

- Therapeutics

- Precision

- Genes

- Cell

- Immunotherapy

- Synthetic Biology

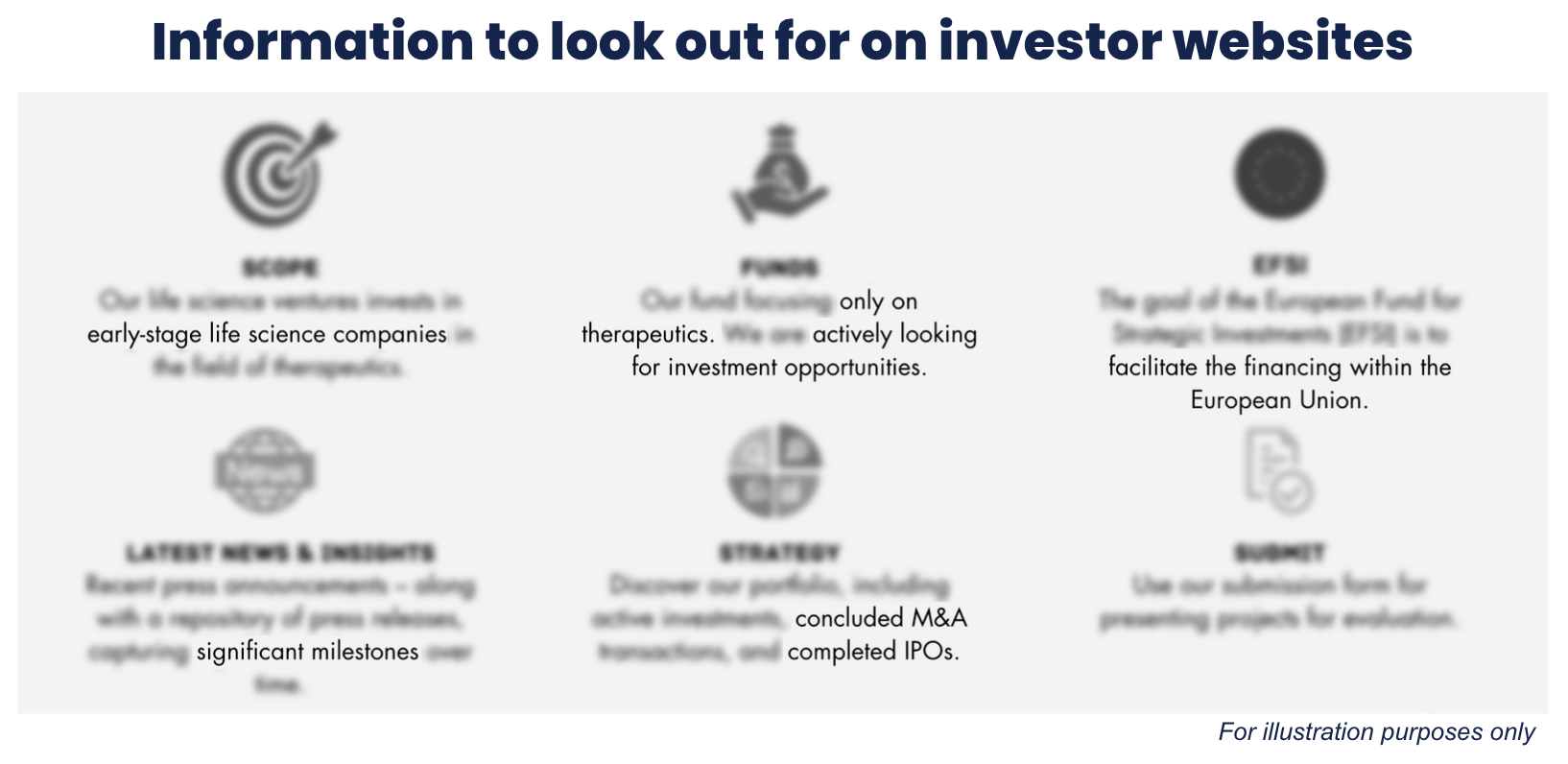

You will see in the list of top life science venture capital firms the areas of interest they are investing in. So, spending time targeting investors who are not interested in your area or company stage is a fruitless endeavor. As an example, look at the information you will find on medical investor websites:

Investor types: finding the right investor

Investors can be divided into different types: their investment types, regional markets, the industries they are investing in, and the company stages they invest in. Although the list on this page does not go into detail, general knowledge is provided for you to start working on your investment plan. You will learn the basics on the following:

- Investor types

- Company stage and market share

- Region and country-specific investments

- Industry-specific investments

- Investment programs

Let’s dive into it!

Investor and investment types

The main categories into which investors and investments can be divided are listed below.

Founders equity

The first investment often needed to get ideas off the ground is founder’s equity. It is the initial investment made by the founders of the company. This investment can be capital but can also be of another type. Founder’s equity can translate into ownership stakes in the company.

Angel investor

An angel investor is often one of the first forms of start-up funding. The angel investor often has a personal relationship with the founders or a connection to the company. The angel investment can translate to ownership equity, can be a loan, or can even be a gift. Sometimes capital funding is accompanied by mentorship or other guidance. The common investment type of angel investor can be pre-seed capital seed capital or growth capital. The latter often when founders’ equity pushed the company through the early start-up phase.

Private equity

Private equity is an umbrella term that stands for equity held by individuals or investment companies. The type of investment is often a venture capital fund, which means that a group of investors invest together in different companies. For venture capital funds, the terms of the funding are predetermined. These include the stage of the business, niche, and location. When you’re in a pharmaceutical biotech start-up, you can look for healthcare investment funds or better yet, for investors in healthcare startups. The better the match with the Venture Capital (VC) firm, the higher your chances of success often are. For instance, medical device VC firms are often less willing to invest in pharma start-ups because they may feel they lack the expertise to conduct a proper risk assessment.

Biotechnology hedge funds

While hedge funds are generally more associated with publicly traded stocks, they can also invest in private companies. In an article from 2006 in Nature Biotechnology hedge funds are discussed. One of the reasons for the article was the estimated doubled investment amount in biotech in the two years prior to the article’s publication date. Biotech hedge funds might not be of interest to start-ups looking for biotech investments. However, the increase in the popularity of biotech on the stock market can boost interest in investing in biotech companies that are still private.

Biotech investments are more suitable for a long-term strategy

For biotech companies that are already trading publicly, the article comes with a critical note. Medical or life science hedge funds might have a short-term investment strategy. Therefore, the long road in market approval for a new drug might not match the biotech hedge funds strategy.

Read the article here: https://library.wur.nl/WebQuery/file/cogem/cogem_t44ffe9a0_001.pdf

Biotech investment banking

Banks can be a solution for biotech companies in need of capital. Two of the top biotech investment banks are J.P. Morgan and Goldman Sachs. As you will see on their websites, biotechnology investment banking comes in several forms and offers more than biotech capital need. For biopharma investment banking, you see both banks offer strong industry expertise and insights. J.P. Morgan’s Annual Biopharma Licensing and Venture Report and Goldman Sachs’ advisory board underline this. Early stage entrepreneurs should keep an eye out for the JP Morgan life sciences fund and the corresponding Life Sciences Innovation Summit.

Company stage and size

As you might already know from searching for biotech investors, many investment funds list the company stage they want to invest in. Another criterion you may see is market share. From this, you understand that for instance, lower middle market private equity firms are less likely to invest in start-ups. One more criterion that can be attached to biotech venture capital funds, is the sub-industry. Meaning a fund is only available to certain companies, depending on what they are developing.

Pre-seed capital or early-stage start-up

Pre-seed capital is capital provided in the earliest stage of a company. It can be needed to create a prototype, evaluate ideas, product development, and market research. Pre-seed capital can be needed even before there is an actual start-up. Pre-seed capital or early-stage start-up capital is often provided by angel investors or by the founder(s).

Seed capital or start-up capital

Seed capital or start-up capital can be needed to cover the initial company operating costs before those expenses can be paid from revenue. Seed stage biotech companies need to look for early stage biotech investors in the form of biotech angel investors or seed-stage venture capital firms. Initial capital invested by the founder(s) can be needed as well, if only to show investors that you as founder believe in your start-up.

Growth capital

Biotech investment firms often mention that they invest in “fast-growing companies”. The fund provided for these biotech companies on the rise is named Growth Capital (GC). Healthcare growth equity firms take only companies in consideration that are in a mature start-up / scale-up stage. These companies typically have a proven business model but lack the resources to gain a significant market share. Growth capital can be used to scale up operations, enter new markets, acquire competitors, or for further product development. This is the stage when a company becomes interesting for private equity firms investing in healthcare. For life sciences private equity firms companies in the critical phases of development are interesting. For example, successfully reaching the next phase of clinical trials can have a huge effect on their asset valuation.

Venture Capital

Venture Capital (VC) is a form of Private Equity (PE). There are many private equity firms, from small to large, and from active in a certain niche to broad-scale investments. When you look at medical investment firms, you often see a physician venture capitalist being part of the team. Industry-focused life science investment firms can have a team of specialists who know the market. Next to providing the start-up biotech capital, part of their strategy can be sharing knowledge, network, and expertise.

Funding series A, B, C, etc.

Funding is divided into different series/funding rounds, indicated with A, B, C, etc. The different series correspond more or less with the stages of a company. Funding in all series can be categorized as growth capital, where series A is the first round after the seed stage. Subsequent series follow as certain milestones are achieved. There are investors who are only looking for series A funding biotech opportunities, so it’s all about finding the right investor for your stage.

Pre-IPO, IPO and exit

Pre-IPO funding falls under late-stage venture capital and is provided before the Initial Public Offering (IPO). The capital can be needed to prepare the company for public markets. After this, the final stage arrives where equity in the company can be traded on public markets. This also means that investors can offload their stocks once the price hits the desired level and they can maximize their investment. After the IPO investing in the company is via public equity.

Mergers and Acquisitions

Mergers and acquisitions start to become relevant from series A funding and onwards. To accelerate growth, to obtain a larger market share, or access new technologies, merging or acquiring companies can save time and resources. The other way around is also possible, where the company is bought by another company. It can be an exit strategy for founders and investors to monetize their investments. An exit through sale, also named M&A sale or M&A deal, comes quicker than the exit through IPO. However, there are more methods for liquidation of assets, like recapitalization or secondary buyout.

Find the right match

You now know the main types of investors and investments. You’ve learned that it is all about finding the right investor for your company. Investors are looking for bio tech companies to invest in, you only need to get in contact to present your story. In the next part of this article, you’ll read more about finding the right match.

Not all med tech investors are similar

Med tech investors can be divided into subcategories like drug development, healthcare, and medical device investors. They can be further divided into the company stages they invest in. Early-stage companies can, depending on their product, look for drug development or medical device seed funding and pharmaceutical products and medical device angel investors. Because of the high risk of venture capital investment, medical device venture capital firms are less likely to invest in pharmaceutical products. However, medical angel investors may still take the risk if they have a strong belief in the founders.

Biotech angel investors vs venture capital firms

What is an angel investor? Angel investors are people who invest their own money, usually in a start-up. A biotech angel investor often has a personal connection to the company, founders or therapeutic area of the company. Many companies have started with an angel investment. The financial backing, sometimes accompanied by mentorship, is especially valuable in the early phase. The terms for the investment are generally different from those of a venture capital firm. Venture Capital (VC) falls under Private Equity (PE). A venture capital firm buys equity (ownership stakes) in a private company.

Things to consider when comparing angel investors with venture capital firms

In the start-up phase angel investors are generally more willing to invest, but the total investment is often lower than that of venture capital firms. Also, angel investors, especially the ones with a personal relation to the founders of the company, might have more flexible terms or lower requirements. How good that might sound for start-ups, it is therefore more important to discuss the terms.

Things to consider

Think about this: What will the angel investor get in return for their risk? What is the exit strategy for the investor and under what conditions can both parties terminate the contract? After the start-up phase, more options become available, like Venture Capital (VC) and Growth Capital (GC). It is important to have a clear strategy so your angel investor does not hold back your company’s future growth.

Finding seed funding as a start-up can be the hardest

When looking for medical investors, especially for medical venture capital firms, you will notice the lack of interest in start-up funding. It is a result of the high failure rate, 60% fail within the first five years and 90% fail eventually. This trend is also visible in clinical trials, where around 90% of investigational new drugs (INDs) eventually fail. By looking at these statistics, you can’t deny that offering investors a de-risking mechanism is appropriate. Especially seed stage biotech companies still looking for preclinical funding should consider Phase 0 clinical trials. It can partially replace preclinical work, while data from clinical trials in patients is generally considered more valuable.

Investors in region and country

Focussing on investors in your region and country can be beneficial. However, their funding scope can be region-transcending. A few examples:

For biotech startups in the Netherlands one of the top medical investors is Gilde Healthcare with a headquarter in Utrecht. This healthcare investor has a Venture&Growth fund for fast growing companies in EU and USA and life science private equity funds for lower mid-market healthcare companies in the EU.

Biotechnology startups in USA looking for investors in healthcare startups can check out Innova Memphis. This early-stage medical investment firm provides (pre)seed capital and mentorship. The company is based in Memphis, Tennessee.

Medical investors and healthcare private equity firms

It is often far easier to convince investors with experience in your field. Investors in healthcare startups understand the business and are therefore more able to spot a chance when they see one. Try to find investors as far in your niche as possible, and divide them further on the other criteria: investor type, company stage, and region. For example, Regal Healthcare Capital Partners solely invest in healthcare service companies. Med Tech Venture Partners invests in medical device entrepreneurs, from the early stage and onwards.

Look for trends in biotech investments

Markets are often dominated by trends, and biotech is no exception to this. Where there are trends, there is often growth. The biotech market is expected to grow by 12.8% each year, to $3.21 trillion in 2030. The bio pharmacy segment had a share of around 41% in 2022. Some trends you can easily find online, are the use of AI in drug discovery and Real World Evidence (RWE), regenerative engineering, bioprinting, stem cell technology, gene editing, Antibody Drug Conjugates (ADCs), and Targeted Protein Degradation (TPD). Other factors influencing the market are related to regulatory, M&A, and government initiatives. As a biotech start-up, you need to stay informed!

Biotech investment programs to apply for

Look for investment programs provided by regional or field-specific investors. These can be seed investments and accelerator programs. Often there is already a certain amount that will be given to the most promising application(s) for the program. Below we provide an example we made ourselves, finding (biotech) investment programs in the Netherlands. You can get ideas to make a similar list for your region and niche.

Example: life science investments in Groningen, The Netherlands

There are multiple initiatives for health, biotech, and life science start-ups in The Netherlands, Groningen:

- HTRIC

- TopDutch

- Netherlands Enterprise Agency

- Life Cooperative

- RUG ventures

- Campus Groningen

- Forbion

- InvestEU

This list does not include all funding options for your biotech start-up in Groningen. It is only meant to provide you with the insight that there are often many opportunities to pitch your biotech start-up to investors.

Frequently asked questions

We’ve covered many different aspects that influence biotech investments in start-ups and scale-ups. Although we as a clinical research organization are best at answering all your questions related to clinical trials, we answer some of the most common questions people have on biotech start-ups.

How do I start a biotech startup?

For a start-up, biotech might be the most difficult field to start in. This is because the catch-22 where you need capital to generate the data that is required to convince investors. This is one of the reasons biotech start-ups are often spin-offs from universities or larger companies. When you have no idea yet about your venture or little experience in working in biotech or life science, you could consider looking up biotech startups internships. When you already have a promising idea, you need to work out a plan to attract investors. Providing a prototype, Proof of Concept, or strong market or scientific data can help. When you are in pharmaceutical development, learn more about Phase 0 clinical trials.

What is considered a biotech startup?

A biotech start-up often works in the field of drug discovery or development. However, there is overlap in the categories: life science, med tech, or health tech. When searching for investors, medical or healthcare investments are the general term. These investors might be interested in biotech investments but are often mostly or solely interested in care, medical devices, or life science IT. In that sense, biotech is a completely different niche of healthcare that focuses on biology, chemistry, bionics, or genetics/genomics. Biotech is not only related to therapeutics or diagnostics in life science but can also refer to other industries where biotechnology is used.

How many biotech startups succeed?

60% of biotech start-ups fail within the first 5 years and eventually 90% will fail. Comparing this to University-licensed start-ups (ULSs) in life science paints a similar picture with one big difference. 10% of the ULSs make it to an Initial Public Offering (IPO). However, 13% were acquired by a company. So, 23% of these start-ups can be counted as making it to the next phase successfully. View the article on ULSs.

What is the failure rate of biotech startups? And why do they fail?

The failure rate of biotech start-ups is around 90%. This matches numbers for start-ups in general. And it’s not only the seed companies who don’t succeed in attracting investors. Estimates are made that venture-backed start-ups have a failure rate of 75%. Meaning they did not reach the IPO or M&A endpoint. Common reasons for failure are lack of funding or issues with product development, management or with the team. Other reasons are no market need or getting outcompeted. Looking at pharmaceutical start-ups, approximately 90% fail in clinical trials. Common reasons are related to efficacy, safety, patient recruitment, or lack of funding.

How to find investors for start-ups?

When you are looking for investors, you’ll notice that there are many private equity firms. What is the largest private equity firm in healthcare? Depending on the list, you see names like Shore Capital Partners ($6B in assets under management) and TPG Healthcare Partners ($4.5B). However, simply contacting the top healthcare investors might be a waste of time. Conducting research can deliver you the list of medical investors with the highest chance of securing your investment. Use the examples below to learn more about making the match with the right investment firm.

More information about healthcare, life science and biotech investors with examples

Finding an investor for your start-up or scale-up is all about reaching out to the right investors. As you’ve learned from this article, you can do this based on the scope of investors or private equity firms. The examples given will underline this and might already give you an idea of life science or biotechnology investment firms to reach out to.

List of healthcare private equity firms

We’ve listed some of the largest healthcare investors and life science and biotech investors in particular.

Bain capital healthcare

Bain capital is one of the largest healthcare private equity firms. Their private equity assets under management represent a value of more than $77B. They can be considered one of the leading private equity firms that invest in healthcare. In life science (therapeutics, medical devices, diagnostics, and tools) their asset value is around $3.7B. They work with companies worldwide and in all stages of growth. From start-up to established companies. Their support goes beyond providing capital, offering companies to go global, or moving a pharmaceutical pipeline through clinical trials. Read more on their website.

TPG healthcare partners

TPG Healthcare Partners is, with a Assets Under Management (AUM) value of $212B a well-known name. TPG Capital healthcare investments are in size around $2.7B. The company does not only invest in healthcare but also in life science and biotech. More importantly for life science and biotech companies, each year around $500M is invested in R&D. The TPG Life Sciences Innovation Fund invests in novel therapeutics, diagnostics, medical devices etc. In their portfolio, you find companies like Allogene Therapeutics and Ellodi Pharmaceuticals. Read more on their website.

G Square Healthcare Private Equity LLP

G Square Private Equity invests in mid-market healthcare companies, most of them based in the EU. This London-based medical investment firm does so with growth capital and a buy-and-build strategy. G Square Healthcare Private Equity not only provides funding but also participates with management teams in strategic and operational decision-making. The company focuses on mature companies with high-growth potential. In their portfolio are companies across a broad spectrum in healthcare. You can read more on their website.

Petra Capital

You can find Petra Capital when you search for lower middle market private equity firms. The firm is focused on healthcare and less specifically on life science or biotech. With a fund of around $200M it is not in the top healthcare investment firms, but if your start-up is in the lower middle market this might be the investment firm for you. Good to know, Petra Capital is willing to take a control or non-control ownership position and is in the list of INC. Founder friendly investor 2022 & 2023.

KKR healthcare fund

Scale-ups that are already generating significant revenue can search for middle market healthcare private equity firms. KKR healthcare is an example of such an investment firm. The company invests in established, but smaller companies with an enterprise value between $200M and $1B. There is also a KKR healthcare growth fund for high-growth companies. KKR works with companies in biopharmaceuticals, medical devices, life science tools and diagnostics, and health care services and IT. Read more about KKR.

Med Tech Venture Partners

Medical device start-ups and scale-ups can contact Med Tech VC. A Med Tech investment can typically be applied for seed start-ups or companies looking for their first venture capital investment. They require from a start-up strong data that supports their business idea. This can be for instance a prototype or (pre)clinical data. Looking at their portfolio, you see companies in therapeutic and diagnostic devices. Read more: https://www.medtechvp.com/.

Archimed Private Equity

With over $7B of managed assets, Archimed is one of the largest biotech investors. Biopharma is a separately mentioned sector of healthcare they are active in. The same applies for life science tools, and in vitro diagnostics. This investment firm is interested in small and mid-size companies. Looking at their Biopharma portfolio, you will find companies in chemistry and manufacturing. Read more on their website.

Venrock healthcare capital partners

When you first look at the Venrock website, you see the broad scale and spectrum of their investments. However, the company has a venture healthcare and public healthcare section. Here you find companies in therapeutics, health tech, medical devices, and life science.

Vivo capital private equity

The word vivo is in biotech known from in vivo and ex vivo, and the name already indicates the orientation of Vivo Capital. It is a biotech investor working with companies in biopharmaceuticals, specialty pharmaceuticals, and medical devices. Their portfolio provides insight into the companies they may be interested in, many of them working on the development of novel therapeutics. Learn more about Vivo Capital.

Sunstone life science ventures

Drug developers looking for a biotech investment should check Sunstone Life Science Ventures. This is one of Europe’s top life sciences private equity firms. Since 2007 this biotech investor alone has supported over 100 clinical trials, divided in Phase 1-3 and resulting in 5 new approved drugs! Sunstone is available for EU and UK-based early-stage biotech companies developing new therapeutics. Sunstone has several healthcare private equity funds, some funds are strictly for certain sub industries. Read their requirements here: https://sunstone.eu/investment-strategy/.

This list of medical investors is only for inspirational purposes and does not provide advice. Data provided is how it is stated by the companies at the time of writing.

How can TRACER help?

TRACER is a CRO (Contract Research Organization) and was once a biotech start-up itself. We found our way in the world of investments and are now helping others. We work globally with companies at every stage in the field of biotech and life science. As a contract research organization, our support is in (pre)clinical trials. Our specialty is conducting Phase 0 Proof of Concept studies with imaging. This First in Human study uses microdosing combined with imaging to generate data on Pharmacokinetics and Biodistribution. The costs of Phase 0 are significantly lower than other clinical trials, while the data is considered more valuable since it already substantiates efficacy.

Learn more about how Phase 0 can help with your investment needs.

Although this article has been composed with great care and attention, we cannot guarantee its accuracy. If you have any suggestions or additions to this article, please email info@tracercro.com.

No rights can be derived from this publication. This blog does not make claim or promote ownership to any intellectual property, study information, clinical images, or copyrighted terms wherein.